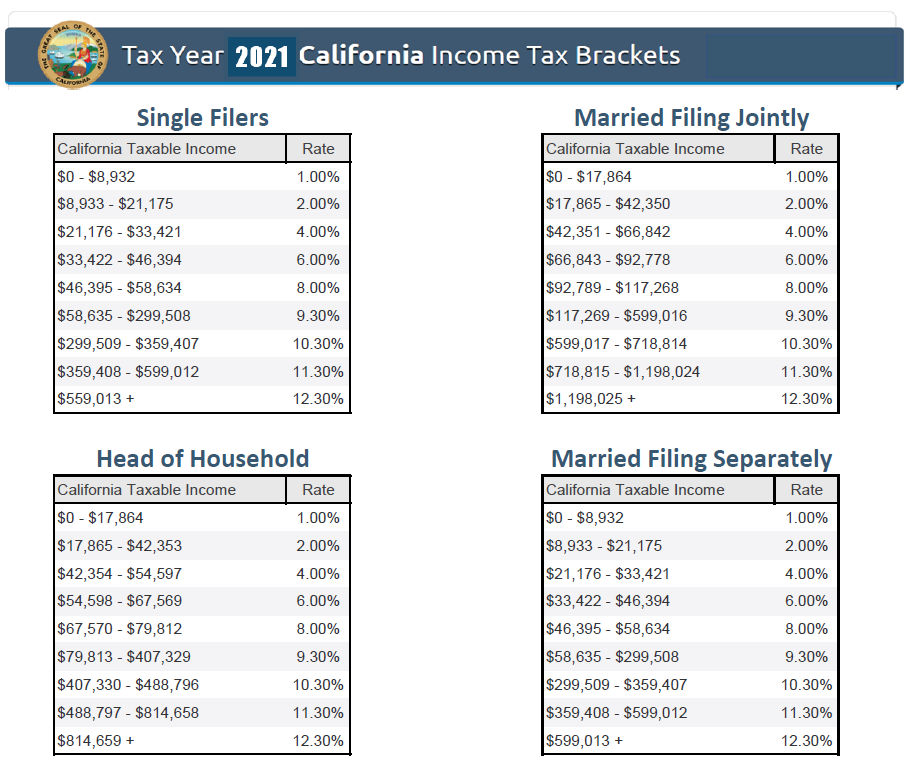

California Single Tax Bracket 2025. The standard deduction will increase by $750 for single filers and by. Enter your filing status and income to calculate your 2025 tax using the online calculator.

California also levies a 1% mental health services tax on income exceeding $1. Your tax rate and bracket are based on your income and filing status.

California Single Tax Bracket 2025 Renie Sonnnie, Compare the single and joint filing tax brackets and see how they change over time.

Tax Bracket 2025 Canada Ontario Lorri Martha, Learn about the nine tax brackets for california income tax, the new top rate of 14.4%, and the deductions and credits that can lower your tax bill.

2025 Tax Brackets California Ines Rebeka, The irs provides annual adjustments for more than 60 tax provisions for tax year 2025, including the tax rate schedules and other tax changes.

Understanding 2025 Tax Brackets What You Need To Know, The ca tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica etc.) allow for single, joint and head of household filing in cas.

Tax Bracket 2025 Calculator Nj Aliza Belinda, California also levies a 1% mental health services tax on income exceeding $1.

2025 Tax Brackets Taxed Right, The irs provides annual adjustments for more than 60 tax provisions for tax year 2025, including the tax rate schedules and other tax changes.

Oct 19 IRS Here are the new tax brackets for 2025, Enter your filing status and income to calculate your 2025 tax using the online calculator.

Here are the federal tax brackets for 2025 vs. 2025 Narrative News, Compare salaries, review tax credits and.